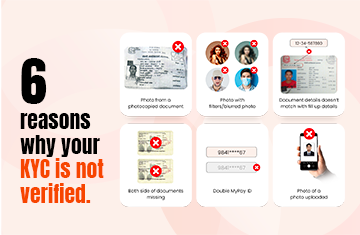

KYC (Know Your Customer) verification is a crucial process to ensure the security and authenticity of user accounts on MyPay. However, there are instances where the verification may not be successful due to various reasons. In this blog post, we will explore six common reasons why KYC verification fails on MyPay, shedding light on the importance of providing accurate and valid information during the process.

One of the primary reasons for failed KYC verification is when users submit photographs that are taken from photocopies of their identification documents. To ensure the integrity of the verification process, it is essential to provide clear and original photographs of the required documents.

Using blurred or filtered photographs can hinder the verification process. It is crucial to provide high-quality, clear, and unaltered images of your identification documents, as any distortion may lead to failed verification.

When the details provided in the KYC form do not match the information present on the submitted documents, the verification process may fail. It is vital to double-check all the details before submitting them to ensure accuracy and consistency.

Some identification documents require submission of both sides, such as driving licenses or identification cards. Failure to provide clear images of both sides can result in failed KYC verification. Ensure all necessary information is visible and legible to increase the chances of successful verification.

Having multiple MyPay IDs linked to a single individual can lead to confusion during the verification process. It is crucial to maintain only one active MyPay account per person to avoid complications and ensure a smooth KYC verification experience.

In certain cases, users may attempt to submit a photograph of their identification documents instead of scanning or using the original digital copy. Uploading a photo of a photo can result in reduced image quality and clarity, potentially leading to a failed verification process. Always use clear and original digital copies for successful KYC verification.

Successful KYC verification on MyPay is essential to maintain a secure and trustworthy platform for users. By avoiding common mistakes such as submitting photocopies, using filtered photographs, or mismatching document details, users can increase the likelihood of passing the verification process smoothly. Remember to provide clear, accurate, and original information and documents to ensure a hassle-free experience on MyPay.